Navigating Opportunity, rental market update

Overall picture

Overall, the market across Scotland is cooling, the supply demand imbalance that the market experienced post the pandemic has narrowed significantly as stock levels rise. There are also further legislative and regulatory changes that are likely to impact on landlord’s costs and potential net incomes. This means the landscape is changing and landlords will need to adapt.

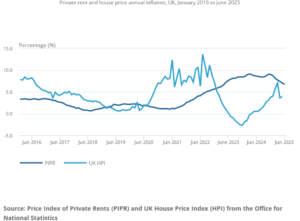

The ONS report that average rents increased to £999 (4.4%) in the 12 months to June 2025 and average house prices increased to £192,000 (6.4%) in the 12 months to May 2025.

Rightmove report rents across Scotland increased by 2.8% year on year Q2 this year and now stand at £1,108 PM

In this article we will focus on Scotland’s two largest cities and take a closer look at the current market conditions.

Navigating Opportunity: The Rental Market in Edinburgh and Glasgow, Q2 2025

As we move through the second half of 2025, landlords and investors in Edinburgh and Glasgow, are facing a market that is evolving but one that also contains opportunity. While economic headwinds and regulatory shifts continue to shape the landscape, both cities remain resilient, offering strong fundamentals for long-term investment.

With greater supply, renters can now afford to be more selective, but people have very short memories and rather than a fundamental shift we believe the market is returning to a more normal and sustainable position with stock levels returning to pre covid levels. The net result is landlords will need to react to the market and may need to reassess rents or invest in some modernisation and improvements to stand out.

Edinburgh: Stabilising Growth

Edinburgh’s property market offers a compelling mix of resilience, income potential, and long-term stability even in uncertain times.

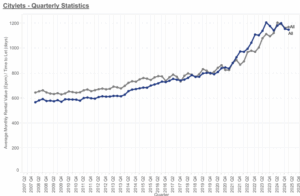

The ONS report that private rent prices across Lothian rose to an average of £1,400 in June 2025, an annual increase of 3.3% from £1,355 in June 2024. This was lower than the overall rise across Scotland of 4.4% over the year.

Taking the data by property type, average rents were:

- Flats and maisonettes: £1,196

- Terraced properties: £1,411

- Semi-detached properties: £1,511

- Detached properties: £2,114

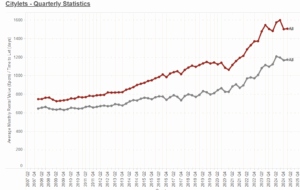

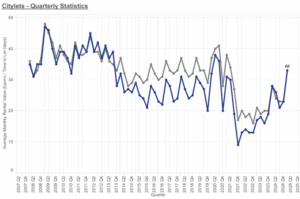

Citylets data shows the av rent for new tenancies in Edinburgh stands at £1506 while in Q1 it was £1501 so no real change.

Demand for HMO’s remains strong from the domestic market though rents have plateaued.

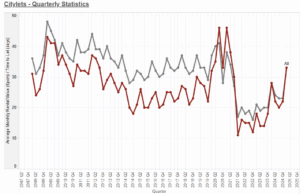

The time to let figures have also increased and now stand at 33 days which is a return to a more normal position.

We feel the market has entered a phase of more sustainable growth following the volatility of recent years. The city has historically shown strong resilience compared to some other UK markets, and that’s down to several key fundamentals that continue to underpin its performance:

- Demand tends to outstrip supply. Edinburgh has a growing population, a strong student presence, and a thriving professional and tech sector. This creates steady demand for quality rental properties, even when the broader economy is under pressure.

- During periods of inflation, property, and residential property can act as a natural hedge. That’s because rents often rise in line with inflation, helping to preserve and even grow an investor’s income in real terms. Edinburgh’s tight rental market supports this dynamic, with upward pressure on rents due to limited supply and high demand.

- The city’s fundamentals help support long-term capital growth. While values can fluctuate in the short term, Edinburgh’s strong employment base, diverse economy, and continued inward investment mean property here tends to hold its value better than in many other areas.

A well-located, well-managed residential asset in Edinburgh can still offer consistent returns, relatively low volatility, and a degree of predictability.

Glasgow: Strategic Potential

The picture in Glasgow is a bit more confusing but is also one of a cooling market Citylets report that the average rent for new tenancies across the city currently stands at £1,150 PM a slight reduction from £1,157 in Q1

Time to let figures like Edinburgh have returned to what would be a more normal position and currently stand at 33 days

The ONS report that private rent prices rose to an average of £1,239 in June 2025, an annual increase of 4.8% from £1,182 in June 2024. This was higher than the rise in Scotland (4.4%) over the year.

Taking the data instead by property type, average rents were:

- Flats and maisonettes: £978

- Terraced properties: £1,171

- Semi-detached properties: £1,290

- Detached properties: £2,109

One bed flats have remained in high demand and have seen the highest levels of rental inflation at 5.5% while properties with four or more bedrooms saw the lowest inflation rates of 2.3%

For landlords and property investors seeking strong returns and long-term growth, Glasgow continues to stand out a promising residential market with some reasons listed below:

- Glasgow offers some of the most affordable property prices in Scotland, with an average of around £188,000 (ONS figures). Compared to other locations this lower entry point allows investors to diversify portfolios or enter the market with less capital. Despite its affordability, Glasgow’s property values have shown consistent growth prices the ONS report that prices have risen 8.3% from May last year.

- Glasgow generates 34% of Scotland’s jobs and boasts a GVA of over £47 billion. It’s a hub for industries like tech, healthcare, and green energy, attracting a young, professional workforce. This economic vitality fuels housing demand and supports long-term capital appreciation.

- From the Commonwealth Games legacy to ongoing infrastructure upgrades, Glasgow is undergoing a cultural and urban transformation. Areas like Dennistoun in the East End, recently named one of the world’s coolest neighbourhoods, are seeing rising popularity and investment. Regeneration projects continue to enhance the city’s appeal to renters and buyers alike.

Glasgow offers a range of property types and neighbourhoods to suit different strategies. From historic tenements in the West End to modern flats in the City Centre, investors can find properties that align with their goals and budgets.

Glasgow’s combination of affordability, rental demand, economic strength, and cultural vibrancy makes it a compelling choice for residential property investment in 2025. For landlords looking to expand or enter the market, the city offers both stability and opportunity.

Investment Outlook: Resilience Amid Uncertainty

Despite an uncertain macroeconomic backdrop and mixed business confidence, Scotland’s property market remains resilient. For investors, the key lies in navigating ongoing regulatory changes while capitalising on strong urban demand and changing supply demand dynamics. Both cities offer compelling opportunities, but success will depend on agility, compliance, and a clear understanding of local market trends. Professional advice when buying is critical to mitigate risk and seek out investments that offer the best opportunity for strong returns.