Overview

With the ongoing cost of living crisis and the eyewatering increases in energy costs it is hardly surprising that energy performance ratings in properties have become a not only a political hot potato but also one that is now at the forefront of most people’s minds across the UK.

The energy price cap is set to increase in October, in May energy regulator Ofgem said the typical household should expect to see an £800 increase to £2,800 a year. But it now says that prices are likely to increase further. Energy industry analysts Cornwall Insight now project that the average customer is likely to pay £3,358 a year from October and then £3,615 a year from January. This is a significant increase from the average bill of £1,400 back in October 2021.

EPC’s for landlords

The Scottish government intends to introduce a requirement for PRS properties to have an EPC rating of C at change of tenancy from 2025. All PRS properties will then be required to reach a minimum standard of C by 2028. Exemptions will be available for properties where it is not technically feasible or cost effective to reach that standard.

In a recent survey by mortgage lender Paragon found the majority of landlords are aware of the proposed minimum EPC ratings requirements. But critically there was a disparity between the amount landlords are willing to pay to meet the new requirements and the potential cost.

The survey found the willingness amongst PRS landlords to meet the new requirements, or at least their chosen method of funding, may be impacted by the substantial difference in the estimated cost of doing so and what landlords are actually prepared to spend. Just over three quarters, 77%, of landlords are willing to spend up to £3,000 to bring each property they own up to EPC C or above but the analysis shows that 78% of landlords would need to spend over this amount. In fact Paragon’s analysis shows the average cost to upgrade a property to EPC C is £10,560, although the UK and Scottish governments have proposed a cap of £10,000 per property.

Landlords should now be reviewing their portfolios and weighing up the cost of any improvements and the potential returns. Investing in making their properties more energy efficient should increase values.

Capital Benefits for Landlords

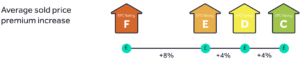

In some recent research Rightmove have found that there is a correlation between higher ratings and capital values. In fact, by improving a property from a F to a C rating a landlord could add an additional 16% to a their property’s value.

Source Rightmove

Furthermore, EPC B rated houses have overtaken D rated houses for the first in in terms of speed of sale.

Mortgage benefits

There could also be other benefits for landlords as the number of green BTL mortgages is on the rise with 353 products available which is the highest ever recorded. Green buy-to-let mortgages offer higher borrowing limits, better rates or other perks to landlords with better Energy Performance Certificate ratings usually requiring an EPC of A, B or C. For those who own buy-to-let property within a limited company rather than in their personal name, almost one in five mortgage products are now green. This is a very serious consideration at the moment when interest rates are rising and are projected to continue an upwards trajectory.

What about tenants

With rents rising at such fast rates landlords will need to carefully consider their options when looking at rent levels to recoup the cost of any works. A recent study by GetGround found that 82% of landlords feel that making energy efficiency upgrades to their properties goes some way to helping tenants protect themselves against rising costs. Nearly seven in 10 (69%) feel a level of responsibility to help their tenants mitigate the cost of living crisis.

Consumer sentiment was already shifting to embrace energy efficiency and the recent huge price increases we have seen has turbo charged this change. EPC ratings have now become one of the priorities for tenants when looking for a new home. Research shows that a tenant moving from a home with an E to a C rating could save £725 annually which is a big financial incentive for them to choose an energy efficient home.

We are now seeing EPC rates one of the main things tenants are considering before they make an application for a home. Properties with lower ratings are clearly less desirable and as such command lower rents. It also seems that tenants will be more likely to stay in a property for longer if improvements are made to benefit the environment and increase energy efficiency resulting in lower void periods for landlords willing to invest.

In line with the energy efficiency expectations smart technology is also increasing in popularity and there is evidence to suggest that properties with smart technology can achieve higher rents.

Conclusion

So, there is definitely a real incentive for landlords looking to improve the EPC ratings in their properties. They should secure higher rents, longer tenancies, lower voids, potentially lower finance costs and finally increased capital values.

If you would like to discuss the proposed changes the EPC regulations, how it might affect you and how we can help please get in touch.