Current economic Picture

As was widely anticipated the Bank of England (BOE) have raised Bank rate by one quarter of a percent to 5.25% as it continues to struggle to bring inflation down to its target rate of 2%. In further bad news for borrowers, it also warned businesses and households that the cost of borrowing is likely to remain high for at least the next two years. The last time the rate was at this level was April of 2008.

That said the markets had begun to price in further rate rises from early June, hence the latest hike was not unexpected. The result is swap rates have been falling since early July so actual mortgage rates may actually continue the slow downward trajectory that we have seen over the last few weeks.

But the picture remains uncertain, if the promise of the Prime Minister to halve inflation this year is met and rates continue to drop then pressure on the Bank to continue to raise rates will be much reduced. The result is the mortgage market may stabilise with mortgage rates potentially dropping further. Even another small rate rise may not significantly affect mortgage rates in the longer term, especially long-term fixed products for 5 or even 10 years.

If the inflation rate doesn’t continue to fall or just stalls then the Bank will be under pressure to continue with rate rises.

In its latest forecast the BOE expect inflation to drop to 5%by the end of this year, though food prices may continue to rise as pressure builds on things like grain due to the ongoing uncertainty caused by the war in Ukraine. It also seems retailers are cutting prices to get cost-conscious shoppers through the door. The British Retail Consortium (BRC) and KPMG’s Retail Sales Monitor show that July saw a “big rise” in high street promotions to tempt Britons hesitant to part with their cash. This could add further deflationary pressure which could further ease inflation.

Rental market

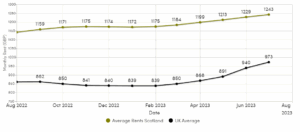

In the most report from Homelet Uk rental prices continue their upward trajectory the average rent in the UK now stands at £1,243. Excluding London, the UK average is now £1,037 per calendar month (PCM). Every region has witnessed an annual rent increase, with Scotland showing the largest, an annual increase of 15.8% when compared to July 2022 to £973 PCM.

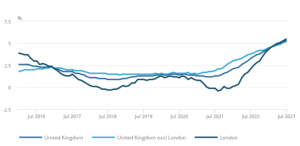

Taking a look at data from the Office of National Statistics (ONS) they report that private rents across the UK rose by 5.3% in the 12 months to June 2023. Their Index of Private Housing Rental Prices (IPHRP) reflects changes for all rental properties rather than only newly advertised rental stock. So, this is an accurate barometer of rental inflation across the UK.

Index of Private Housing Rental Prices percentage change over 12 months UK and London January 2016 to July 2023

Source ONS

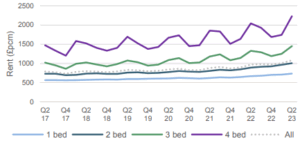

Citylets have published their Q2 2023 Report, rents across Scotland continue to show year on year increases. In fact, rents have risen by double digits for the third quarter in a row since the introduction of the Cost of Living (Tenant Protection) (Scotland) Act 2022 (COLA). The average rent for new tenancies in Scotland now stands at £1081 a year on year (YOY) increase of 11.4% a slight reduction from the 12.4% recorded in the previous quarter.

Average rent (pcm) by Number of Bedrooms

Source Citylets

Homelet report that rents for new tenancies increased in Scotland by 15.8% annually and 3.5% monthly. The average rent for a new tenancy in Scotland is now £973 PM.

Average rental value for new tenancies in Scotland

Source Homelet

The IPHRP for Scotland is 5.7% which is the highest percentage rise since the data series began in January 2012. This increase has occurred despite the COLA though the rise in annual rental price inflation for Scotland since this bill was passed will largely reflect increasing rental prices from new lets as they continue to feed into the Scotland IPHRP stock measure.

Rents for new tenancies in Edinburgh increased YOY by 15.1% with the average now standing at £1,477. All sizes of properties saw increases with two bed properties seeing the highest YOY increase of 12.8%. The average time to let in the city stands at 19 days with one bedroom properties letting the fasted at 16 days

Sales market

August tends to be a quiet news month as our politicians are on their hols so journalists are looking for other stories to fill column inches. Property can always provide subject matter and thus we see plenty of headlines forecasting doom and gloom with potential precipitous falls in values some suggesting by as much as 30% but as the saying goes “bad news sells newspapers”

So, let’s now take a look at some actual numbers. The Nationwide building society have reported that prices fell 3.8% year on year, the sharpest drop since July 2009 when the global economy was in the grips of financial crisis. It compared with a fall in annual prices of 3.5% in June. There was a slight fall of 0.2% over the month, after taking account of seasonal effects. As a result, the price of a typical home is now £260,828 which is 4.5% below the August 2022 peak.

Rightmove report that average new seller asking prices fall by 1.9% (-£7,012) this month to £364,895, the biggest fall in August since 2018.

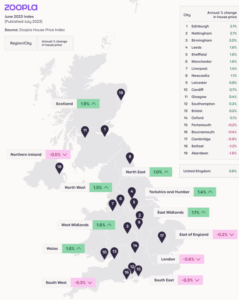

Zoopla figures show house inflation slowed to +0.6% down from +9.6% seen in June last year demand levels have also reduced by 18% as a result of the higher mortgage rates we are seeing. What is interesting is if you dig a little deeper into the data affordable markets in economically active areas are still registering positive growth. Scotland is the area that seem most resilient posting growth figures of +1.9%.

Source Zoopla

So to claim the current falls we are seeing in headline rates mean the UK property market is about to crash and is in crisis is somewhat of an exaggeration. We do not subscribe to some of the more sensationalist “Click Bait” type headlines prophesising doom and gloom with some predicting precipitous drops in values. It seems that pessimism is a national obsession and perhaps we should really be thinking about realism!

Despite the testing conditions in which the market has had to operate, it has proved itself to be remarkably resilient in recent months. It is also worth pointing out that asset prices can go down as well as up, and a correction was always likely after the post-lockdown boom. Such a correction has been made inevitable by the sharp increase in mortgage rates over the past year.

Certainly, the market is more price sensitive and we would be foolish to suggest the current economic volatility won’t have further impact. We expect house price growth to slow and flatten over the short to medium term but headline, national figures will hide complexity at a more regional level which may offer the well advised investor opportunity.

We believe the housing market seems to be entering a period of stabilisation rather than a sharp downward readjustment with a reset towards a healthier and more sustainable level. This no bad thing after a couple of years of unprecedent and unsustainable growth fuelled by the pandemic and historic low borrowing costs.